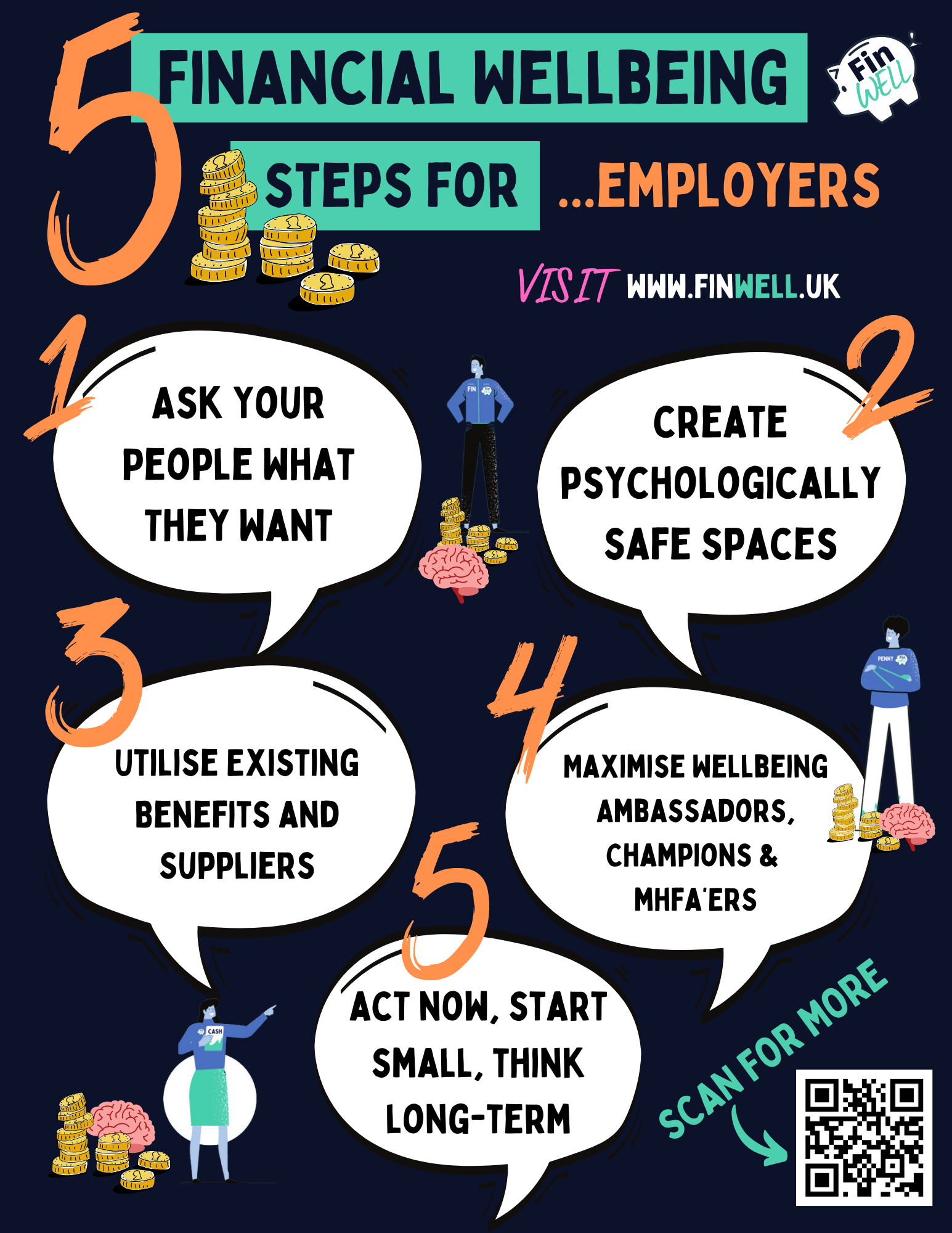

5 Financial Wellbeing Steps for Employers

)

FinWELL Training Ltd are an award-winning financial education and wellbeing training company working with employers of all sizes and sectors throughout the UK and now globally. They have a unique approach linking financial education and wellbeing to mental health and suicide prevention.

They've put together 5 steps to help employers address the financial wellbeing of their employees.

1. Ask Employees What They Want

The biggest barrier we see with employers of all sizes when it comes to approaching financial wellbeing is where to start!

But it doesn’t have to be complex or complicated. The best first step is to simply ask your people what they want. This can be done via your employee surveys or in discussion groups and can identify things such as what challenges are people facing right now and what type of support would they be interested in. Do they want access to safe and trusted educational content and would they prefer articles, videos, podcasts, infographics or a selection of all these things rather than the ‘google effect’ and the potential rabbit holes that comes with online searching? Are they interested in group workshops and if so, what topics and themes would be most relevant? Are there common life events and stages that are affecting your workforce that could be an area of focus for you? Would they appreciate 1-1 support to have private and confidential conversations and be signposted to relevant resources and existing employee benefits? Are they struggling with the current policies and processes with things like expenses and commuting/travel arrangements?

There are lots of questions but the more you ask, the more inclusive and personalised your approach can be while also being data-driven, just make sure you act on the data!!

2. Create Psychological Safe Spaces

This is a big one. Once you have an idea what your people want you need to encourage them to #TalkAboutMoney. It remains a sensitive subject and there is an even bigger taboo around talking money and financial wellbeing than there is around mental health. That shows how far we’ve come with mental wellbeing awareness and education but we’re definitely a few years behind when it comes to financial wellbeing. Many employers we’ve worked with had reservations at this point as they thought it could potentially open a ‘can of worms’.

We’re not talking about declaring pay or levels of debt, just the basics that we didn’t learn at school. There are various things you can do here including educational workshops linking financial wellbeing, mental health and even suicide prevention covering various key topics, themes, life stages and events. You can also encourage managers and senior leaders to share stories of the challenges they’ve faced at various times. It’s important to bring both employee and leadership teams together here so it doesn’t feel like an ‘us and them’ scenario. If you do work with external providers to provide workshops then ensure some of your leadership team get involved and make them as interactive and engaging as possible, one-way presentations have limited impact.

3. Utilise Existing Employee Benefits

We’ve learnt that most employers have really good employee benefits, but the challenge comes when trying to communicate them with their teams and more importantly, joining the dots so they realise how they are relevant and how they can actually be of benefit. The first step is to look at when and how you’re communicating these benefits. Then maybe consider using training providers and reward specialists (not just your benefit providers as they won’t be impartial), who can explain how these benefits work in a practical sense so employees can make informed decisions around the right benefits at the right time.

You don’t need to stick to the traditional onboarding overload or benefits window, get creative by utilising wellbeing awareness days and weeks linking financial, mental and physical wellbeing and also look at various forms of engagement such as emails, WhatsApp, posters, videos, QR codes and in-person events.

4. Maximise Wellbeing Champions & Employee Network Groups

Recently we’ve been asked to create ways to upskill managers, leaders, mental health first aiders and wellbeing champions internally so they can build the knowledge and confidence needed to support their teams when needed. Similar to mental health training, this can give employers an invaluable resource internally to spot the signs of poor financial wellbeing, have empathetic conversations and then effectively signpost to employee benefits and other relevant resources.

Employers are now recognising the power of employee network groups to help raise awareness, spread the wellbeing messages and be available to support colleagues of all levels and departments across the business. Just ensure that you carefully consider who you invite to become champions and offer ongoing training and support.

5. Start Small, BUT JUST START!

It can feel a bit scary and overwhelming, but the first step really is the most important and your initiatives and strategy can evolve over time as you learn what works and what doesn’t.

We’ve been lucky to work with 100+ employers of all sizes and sectors and we started small with every single one of them. You don’t need to sign up to the latest shiny platform or app as that can always come later and avoid big (potentially costly) decisions needing to be made with risks of uptake and engagement. We’ve had most success starting with some data gathering exercises and then doing some kick off launch workshops to really set the scene and build some momentum. As with any successful initiative, it’s really important to be able to measure progress and regularly review what’s working so you can continuously tweak things to maximise impact and of course, return on investment.

Who are FinWELL?

FinWELL Training Ltd are an award-winning financial education and wellbeing training company working with employers of all sizes and sectors throughout the UK and now globally.

They have a unique approach linking financial education and wellbeing to mental health and suicide prevention.

Services include educational content, data gathering, group workshops (online/in-person) and 1-1 sessions. They have also recently launched their CPD Certified FinWELL (Financial Wellbeing) Champion®️ Training to up-skill leaders, managers, mental health first aiders and wellbeing champions internally at the workplace.

FinWELL also created the www.financialwellbeingmonth.com awareness campaign to link financial wellbeing, mental health and suicide prevention for all workers and workplaces in partnership with MHFA England and the R;pple Suicide Prevention Charity.

For more info visit www.finwell.uk